An Inch Wide, A Mile Deep

Why New Beverage Brands Should Master Rivers Before the Ocean

How many of you have heard the phrase “Build your brand an inch wide and a mile deep”? Maybe it popped up on LinkedIn between memes, or was tossed casually in a meeting by a seasoned distributor cradling a box of sample bottles. But for beverage pros, this isn’t just industry jargon, it’s survival advice. In this world, starting in rivers and lakes before jumping into the ocean can be the difference between becoming a local legend and getting lost at sea.

Start Where the Paddle Can Touch

Picture this: a canoeist representing a young beverage brand paddling along rivers and lakes, enthusiastically greeting the local bars, taverns, and mom-and-pop shops on the shoreline. In the distance, the wide ocean teems with massive, seasoned brands (yes, that’s a whale out there).

Why?

Because the deepest relationships, real velocity, and brand loyalty are built close to shore, not in open water.

The Tale of Two Launches: Storytelling from the Field

Let’s set the scene, two coming-of-age brand stories. One group, armed with spreadsheets and big ambitions, blitzes every store and city in sight, determined to conquer the sea. The other, “The Canoe Crew,” starts local, pours into the community, and becomes part of town folklore (like that time they hosted “Trivia Night with Banana Suits”). After six months, the blitzed brand is everywhere and nowhere. The local team? Rooted deep, requested by customers, actually poured, and part of the cultural fabric.

Growth: A River Runs Deep

Building Deeper Before Wider Pays More Dividends

Here’s how most beverage brands really grow their footprint:

- The Local Stream (0–50 accounts): Early traction comes from relationships, hand-sells, tastings, and storytelling. These accounts are loyal, vocal, and create a ripple effect.

- The Lake (50–500 accounts): Momentum builds. Distribution grows, awareness compounds, and early advocates become your local sales force. You’re not everywhere, but you’re everywhere that matters.

- The River (500–1,500 accounts): Expansion meets consistency. You refine your execution playbook, identify hero SKUs, and master your market channels.

- The Ocean (1,500+ accounts): Scale only works if you’ve earned depth first. Without that foundation, the brand gets washed out by the current.

Practical Wisdom: Build Deep with Smart Resources

So how do brands thrive locally and prepare the leap to broader waters? By investing resources and attention where it counts most.

Tastings & Sampling Events

Distributor Incentives

Point of Sale (POS) Magic

Team On the Ground

Ecommerce & Digital Spend

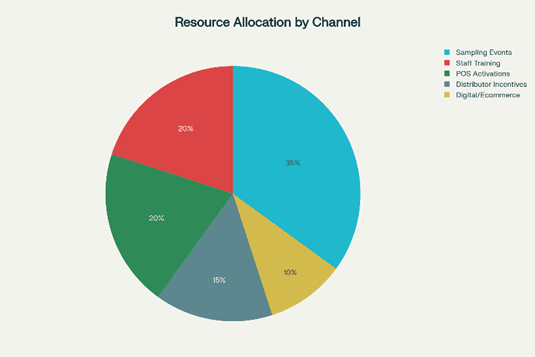

Where New Brands Spend the Smartest

Wonder where the real magic happens in a brand’s early years? Here’s where the most successful allocate their resources:

Where beverage brands put their early resources: heavy emphasis on sampling and staff engagement

Sampling Events: 35%

Staff Training/Engagement: 20%

POS Activations: 20%

Distributor Incentives: 15%

Digital/Ecommerce: 10%

It’s proof that depth is built face-to-face, on the street, and on the shelf, with the digital world amplifying it, not replacing it.

Let Your Story (and Humor) Travel

The Lake, the River, and the Ocean

The truth: oceans are the domain of whales and sharks, the brands with data, dollars, and decades of proof of concept. If you’re new, start in the local streams and lakes. Build genuine fans, turn accounts into champions, and become the brand people talk about at trivia night.

Prove you can win at home first. When the tide turns, and opportunity calls, you’ll be sought after, not just another driftwood bottle among the waves.

Start small, dig deep, laugh often, and when it’s your time in the ocean, you’ll be ready to make legendary waves.

Truthfully,

Sam

Co-Founder BevAssets

🐋 Resources & Further Reading

Sources:

- Ben Salisbury: How to Grow Sales with the Inch Wide, Mile Deep Strategy

- NetSuite: This Creative Craft Distillery Expanded to 11 States in a Single Year

- Polaris: Brand Promotions Best Practices for Alcohol Sampling Promotions

- Overproof: Prepping Your Alcohol Brand for SOND Sampling Events

- Overproof: Role & Functions of Liquor Distributors

- OHBev: POS Design Services for Alcohol Brands

Further Reading: