Why the Tortoise Wins:

Slow, Steady, and the Real Formula for Lasting Beverage Success

Raise your hand if you know someone who snagged 50 new placements last month and blew up your LinkedIn feed celebrating it. Buzzwords fly. “Crushing it!” “Domination!” “Disrupting the shelf!”

A few months later, though? The buzz is gone. Bottles are gathering dust. And that founder? Nowhere in sight when the reset wipes the slate clean.

Here’s the real talk: This industry is packed with hares, those racing for flashy wins and falling flat when their brands vanish at the next reset. But the beverage leaders of 2025? They’re tortoises. They build what lasts. They transform placements into repeat velocity, becoming must-haves, not just one-hit wonders.

Even in the beverage industry, slow and steady still wins the race.

Takeaways Up Front

- Placements don’t build brands, velocity does. Shiny scorecards fade, but reorderPlacements don’t build brands, velocity does. Shiny scorecards fade, but reorders create long-term value and shelf security.

- Support matters more than shelf space. Ongoing activation, training, and account nurturing move product and build loyalty.

- Velocity and reorder data, not door counts, predict who thrives post-reset. The brands who treat each account as a relationship, not a conquest, win the marathon.

The Allure (and Trap) of Vanity Metrics

Everyone wants to hit triple-digit PODs. The PowerPoint decks balloon, the metrics rack up, and the “shelfies” rain down. But behind those numbers is the only statistic that matters: what percentage of those placements reordered last quarter? The data is clear: headlines make noise, but only supportive, quality distribution makes a brand a contender for acquisition and long-term shelf survival.

Slow-moving brands gather dust, while engaged staff and creative activations move cases—and win reorders.

The Data Says: Support Wins

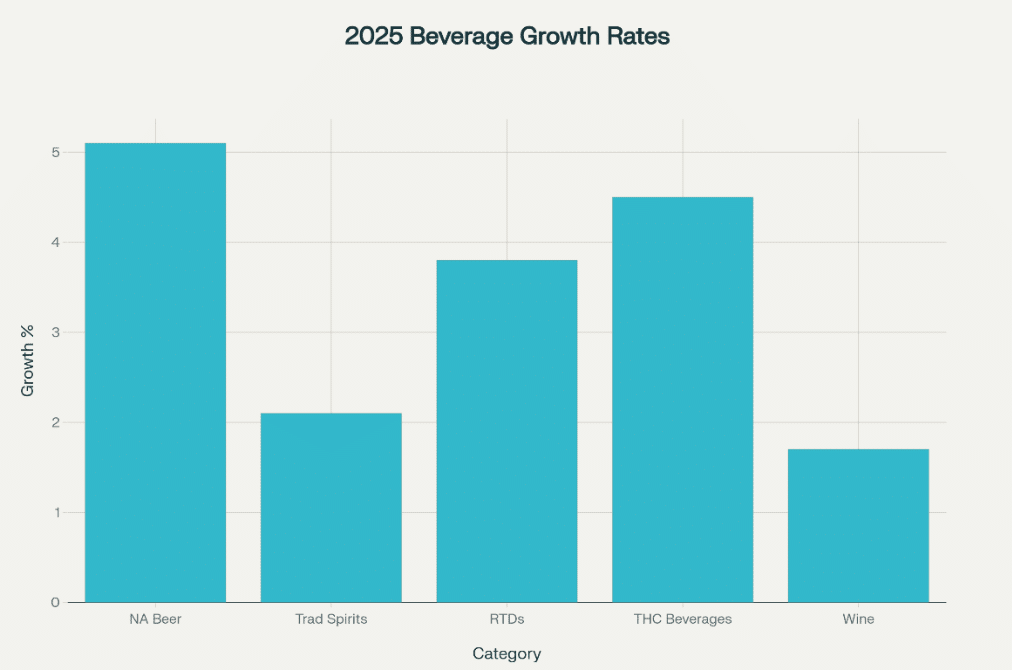

In 2025, new beverage segments are upending old norms:

Year-over-year growth by beverage segment in 2025. NA beer leads all categories

NA beer and THC beverages are booming, but only when brands pair placements with robust support. Traditional spirits and wine brands? If they don’t pivot from “set and forget” to “support and sell-through,” reset risk multiplies. Growth means nothing if bottles collect dust, especially with functional and nonalcoholic categories surging.

The Tactics of the Steady Winner

The best brands, regardless of category, have a playbook for velocity:

- Staff Education: Memorable, practical training for staff, never just a deck or product dump.

- In-Market Activations: Demos, digital campaigns, and events that make the product come alive for customers… and for staff too.

- Ongoing Rep Engagement: Regular check-ins with distributors and field teams. The brands who show up, sell through.

- Data-Driven Action: Velocity dashboards catch slow accounts fast, so support is always proactive.

Brands that invest in in-store demos and ongoing support don’t just get placements—they get advocates and reorders.

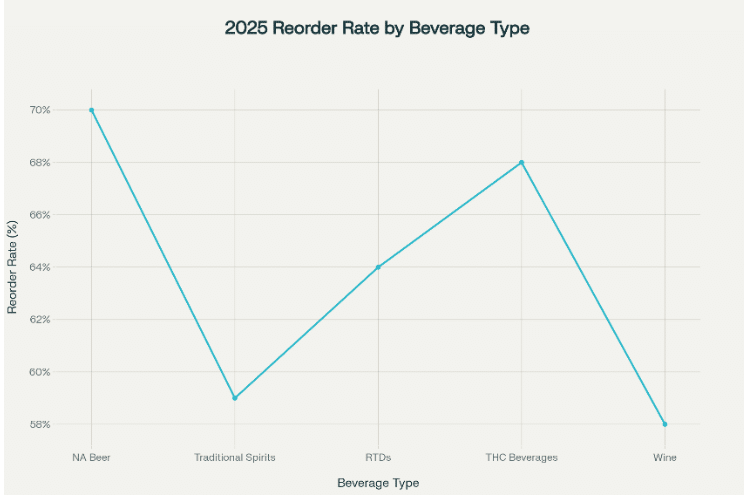

Average reorder rates by beverage segment in 2025. NA and THC beverages outperform traditional categories

NA and THC brands build reorder loyalty by offering more than just product , they offer partnership, education, and creative field engagement. That’s what drives these higher reorder rates.

Playing and Surviving the Reset Game

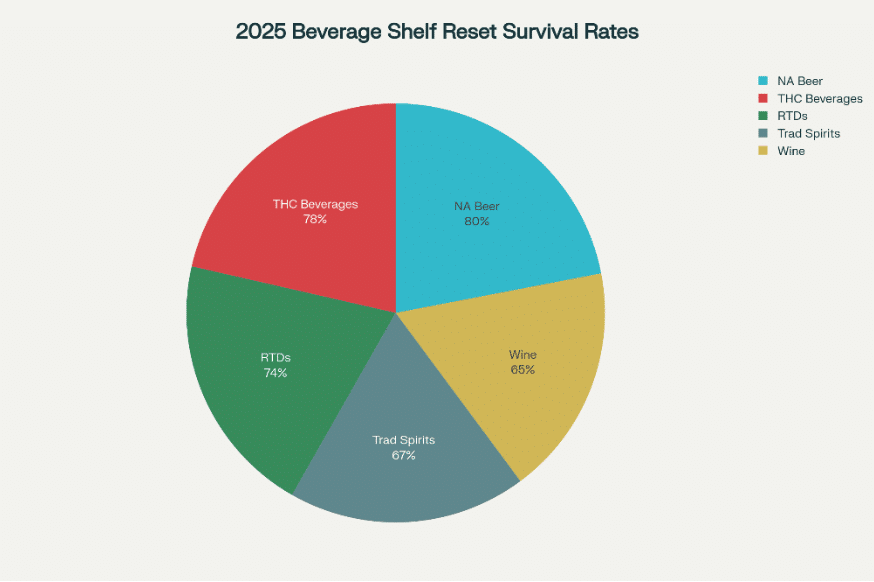

Reset season is brutal. Often, it’s the brands who looked unstoppable at launch that get delisted, while slow-and-steady winners build permanent homes on the shelf:

Shelf reset survival rates in 2025. NA beer and THC beverages maintain the highest survival

In 2025, data shows over 60% of RTD, THC, and nonalcoholic launches that didn’t hit their velocity and reorder targets were cut during resets, no matter how massive their initial push.

The Tortoise’s Toolbox: Resources for Durable Brands

Real competitors make it part of their DNA to support and empower every account. Here’s where to start:

- SevenFifty Daily: Toolkit Services

- Velocity XP: Staff Training & Support

- OH Bev: RTD & NA Launch Guides

- Provi/SevenFifty Daily: Media Kit: Activation Guides

- IWSR: 2025 Market Trends

- Capstone Partners: Beverage Market Update

- CGA US: On Premise Spend Set to Rise

- LA Times: Industry Insights

Final Word: Run the Race That Matters

Celebrate every win but know what matters most. When the applause fades, will your brand be quietly racking up reorders and drawing loyal support? Or will it be another lesson in how not to build a beverage business.

If you want compounding wins, train your team, support your partners, and treat every POD as the beginning of a relationship, not a finish line.

Here’s to the steady, durable, and supportive, the beverage industry’s real winners.

Cheers to realignment and greater success!

- Sam Anderson

Just Pick Up The Phone

Empowering individuals through meaningful connections, one person at a time.

Co-Founder BevAssets.com

🐢 Data and Visual Sources

- IWSR: Global beverage Alcohol Market Set For Moderate Recovery in 2025 While Challenges Persist in 2024

- OH Bev RTD: Market 2024 Comprehensive Overview

- SevenFifty Daily: Toolkit Services

- Velocity XP: Staff Training & Support

- Provi/SevenFifty Daily: Media Kit: Activation Guides

- Capstone Partners: Beverage Market Update

- CGA: US On Premise Spend Set to Rise in 2025

- LA Times: Food & Beverage Industry Insights 2025